Process Mining is becoming more important in business process analysis and many companies are starting their first Process Mining project. The process mining market size is estimated to have grown 70% in a year. There are a lot of great process mining platforms on the market, and it might be difficult to select the right one for your company.

In this first part of the blog series, we try to guide you through the basics of the selection process: why you should start with process mining, and an overview of the process mining vendors. In the second part, the evolutions in the market, important questions, and the basic pricing elements will be discussed.

Whether you are a manager, process owner, auditor, consultant, or business analyst… find the best Process Mining solution for your use case!

Why should I start with process mining in my company?

Optimizing complex business processes might be a difficult and lengthy project with information based on process designs or subjective input from employees. With process mining, you can discover, monitor, and improve your company’s real processes, not the assumed process. You can turn data into real action. This is done automatically by extracting knowledge from event logs available in a company’s information systems.

We can efficiently analyze these logs to evaluate how business processes are performed. This is done in a very intuitive and visual way. It can provide clear insights into complex business processes, bottlenecks, or blocking issues. The software enables employees to find data-driven improvements to reduce costs and get full transparency of what’s going on in your systems.

Conformance checking ensures business processes are executed correctly and alerts users where process steps are being missed or skipped, down to the exact employee. By completely understanding how your employees or IT systems are performing, project managers and technical teams can develop and automate adequate workflows. This is difficult with classic reports. Each of the process mining solutions mentioned in this article can help operations professionals recognize how their processes perform. Process mining software is the perfect tool to provide actionable insights automatically to help in process analysis and improvement.

Process Mining software suppliers overview

There are numerous process mining software suppliers available: Celonis, IBM Process Mining, Microsoft Minit, UiPath, QPR Software, Appian, SAP Signavio, Apromore, Kofax Insight, PAFnow, Logpickr, and many more. To achieve success, it is critical for enterprises to select the right process mining technology partners.

Most of the process mining tools on the market can integrate with a variety of software in a company’s existing IT architecture. Such integrations include ERP systems, CRM software, supply chain platforms, document capture systems, and many others.

Selected process mining software should ensure the necessary features to realize the prioritized use cases. The organization needs to decide on specific use cases for process mining. Who will be using process mining and why? The selected use cases are mapped to features. Most importantly, the selected process mining software should be able to process logs of the specific software used in your company. Otherwise, the process mining platform will require more manual intervention while extracting insights from software logs.

Vendor Evaluation

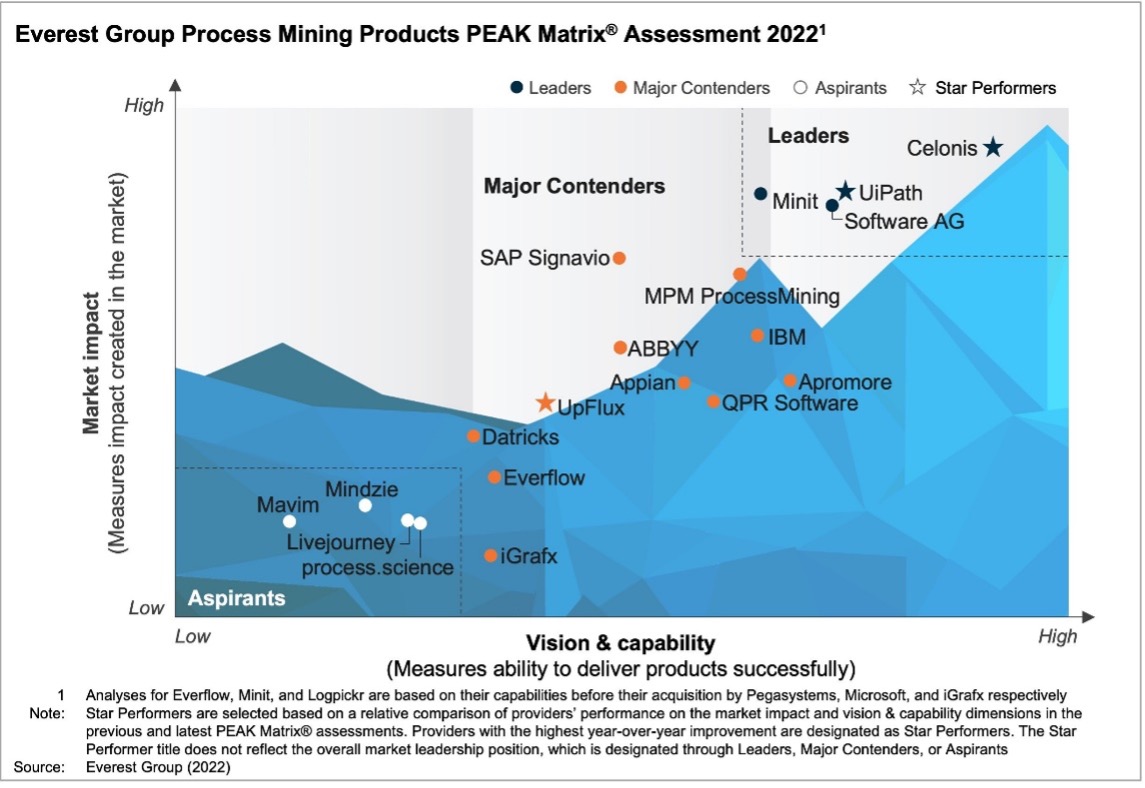

Recently, Celonis, Software AG, Minit, and UiPath were recognized as Process Mining Leaders by the Process mining vendor ranking of Everest Group. In this report, 19 process mining technology providers were evaluated and positioned on the Everest Group’s PEAK Matrix®, categorizing them into Leaders, Major Contenders, and Aspirants based on their capabilities and offerings. This market research can help buyers select right-fit technology providers for their needs and enable providers to benchmark themselves against each other.

The areas assessed by Everest Group for each of the Process Mining vendors included market adoption, portfolio mix, delivered value, vision and strategy, process setup & integration, process intelligence, implementation & support, and vendor’s commercial model.

Leaders: Celonis, UiPath, Minit, and Software AG

These 4 Process Mining leaders continue to differentiate themselves by offering innovative features such as action triggers, AI-based process simulations, and next-best-action recommendations. They keep investing in robust training programs, thought leadership initiatives, and service provider partnerships, to increase awareness in the market.

These companies are expanding their packaged solutions to a wide variety of processes and systems to accelerate the adoption of process mining.

They are ahead in offering pre-built integration with Business Intelligence platforms, such as Qlik, Microsoft Power BI, and Tableau, to increase the power of analytics and visualization capabilities. Furthermore, they are focusing on forging partnerships with or developing in-house capabilities for complementary technologies such as RPA, IDP, process orchestration, and conversational AI.

Celonis and UI Path are the only vendors who are considered star performers.

Major Contenders: ABBYY, Appian, Apromore, Datricks, Everflow, IBM, iGrafx, MPM ProcessMining, QPR Software, SAP Signavio, and UpFlux

Major Contenders are next in offering advanced process discovery and monitoring features. They are also focusing to enhance conformance checking capabilities such as offering out-of-the-box process templates for benchmarking analysis and AI-based root-cause analysis.

A few Major Contenders are differentiating themselves by investing in development to offer increased simulation capability and enhance the predictive monitoring features to identify potential issues and trigger proactive alerts via email or message. Some of them are also offering task mining capability either through in-house investments or third-party partnerships. While these organizations are expanding their presence across industries, geographies, and buyer sizes, they have relatively fewer partnerships with service providers; thus limiting their ability to support large-scale implementations.

Aspirants: Livejourney, Mavim, Mindzie, and process.science

Aspirants are recent entrants in the market. They are investing in expanding data preparation functionalities, improving core process mining capabilities like process discovery and conformance checking, and developing advanced process monitoring functionality. All 4 offer a SaaS-based process mining solution. Most Aspirants are creating their target audience and separate themselves by serving client needs in specific use cases or buyer size segments.